how to calculate nj taxable wages

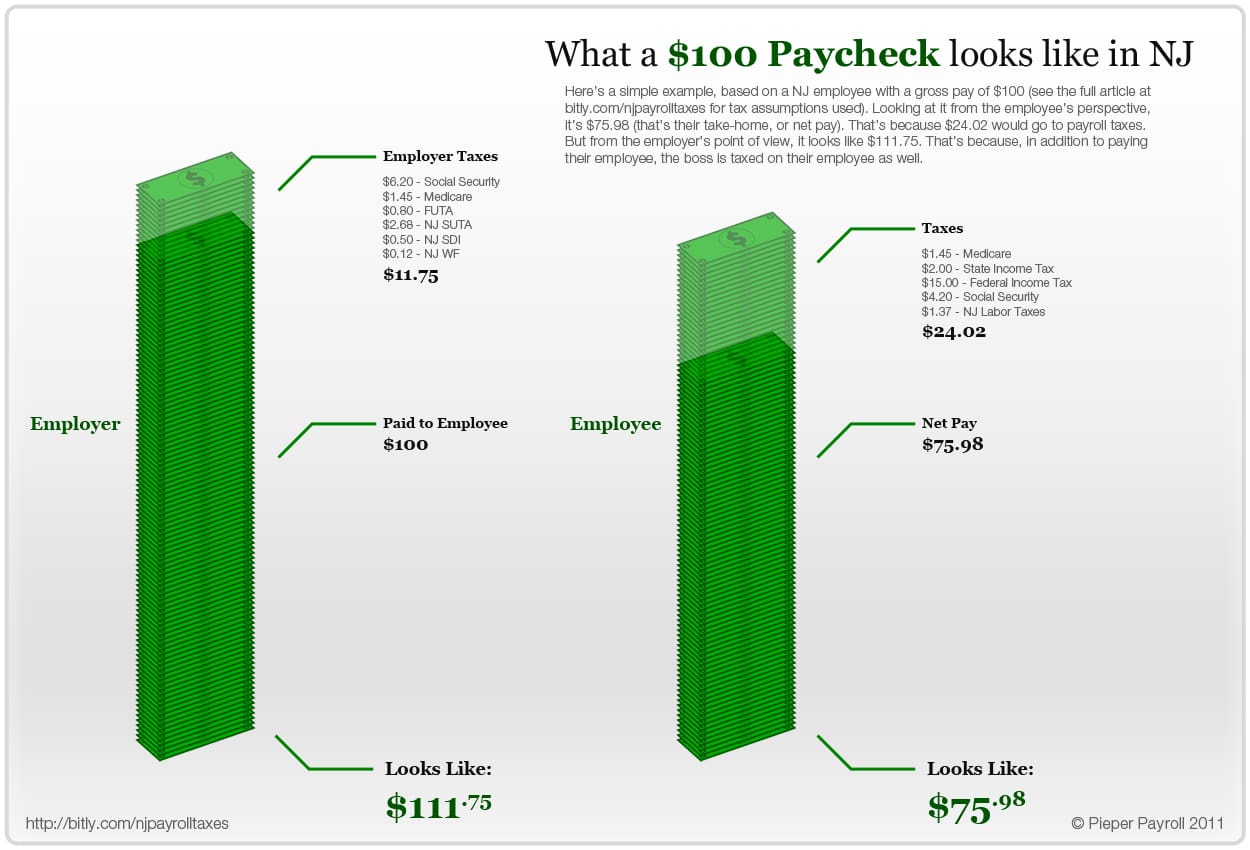

Gross wages - Non-taxable wages - Pre-tax deductions Taxable benefits Taxable wages. New Jerseys maximum marginal income tax rate is the 1st highest in the United States ranking directly below New Jerseys.

New Jersey Nj Tax Rate H R Block

Apply the taxable income computed in step 3 to the following table to determine the annual New Jersey tax withholding.

. You will either be taxed using the Three Year Rule or the General Rule which you will determine when you start collecting the retirement. If the amount is zero enter 0 For more information on wages and other compensation subject to withholding see the New Jersey Gross Income Tax Instruction Booklet Form NJ-WT. Using our New Jersey Salary Tax Calculator.

All of the rates above apply to New Jersey taxable income which is total income including capital gains minus certain deductions as well as the New Jersey personal exemption of 1000. Ad Calculate your tax refund and file your federal taxes for free. The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount.

On your NJ tax return you will recover your contributions tax free. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans. When you begin to receive distributions they will be reported on Form 1099-R.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. New Jersey Paycheck Quick Facts. Exemption Allowance 1000 x Number of Exemptions.

You must report all payments whether in cash benefits or property. Help with how to calculate taxable income is here. New Jersey income tax rate.

Confirm Number of Dependants. What income is taxable in New Jersey. Press Calculate to see your New Jersey tax and take home breakdown including Federal Tax deductions.

NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. Line balance must be paid down to zero by February 15 each year. 175 on taxable income between 20001 and 35000.

Taxable Retirement Income. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. Check the box - Advanced NJS Income Tax Calculator.

Personal income tax 14 on the first 20000 of taxable income. 35 on taxable income between 35001 and 40000. How to use the tax calculator.

In 2022 the federal income tax rate tops out at 37. New Jersey collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Minimum monthly payments apply.

There are two main types of. Either way you will not pay taxes on your contributions again. NJ Income Tax Wages.

New Jersey Bonus Tax Aggregate Calculator Change state This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

Here is the formula for calculating taxable wages. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Withholding Requirements for Certain Construction Instructions for the Employers Reports Forms NJ-927 and NJ-927-W. If you are single or married and filing separately in New Jersey there are seven tax brackets that apply to you.

If approved you could be eligible for a credit limit between 350 and 1000. Only the highest earners are subject to this percentage. Census Bureau Number of cities with local income taxes.

The filing status affects the Federal and State tax tables. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year.

Does NJ have a standard deduction. New Jersey Tax Rate 2017 Nj Employment Payroll Taxes Before you can start thinking about New Jersey payroll taxes you need to first calculate federal payroll taxes. How to use the advanced New Jersey tax calculator.

Line 1 - Wages and Other Amounts Subject to Gross Income Tax Enter the total wages and other amounts paid during this quarter that are subject to GIT Withholdings. How to calculate income tax in New Jersey in. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The Unemployment Trust Fund reserve ratio is calculated as follows. Employers are required to withhold 22 percent to pay to the IRS. Enter your annual income in New Jersey.

Some forms of income that are not taxable include unemployment compensation Social Security benefits workers compensation and lottery winnings of 10000 or less. 5525 on taxable income between 40001 and 75000. New Jersey does not have a.

If you are a New Jersey resident wages you receive from all employers are subject to New Jersey Income Tax. At the lower end you will pay at a rate of 140 on the first 20000 of your taxable income. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Unlike the Federal Income Tax New Jerseys state income tax does not provide couples filing jointly with expanded income tax brackets. There are two main types of wages. Check cashing not available in NJ NY RI VT and WY.

Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all. The more someone makes the more their income will be taxed as a percentage.

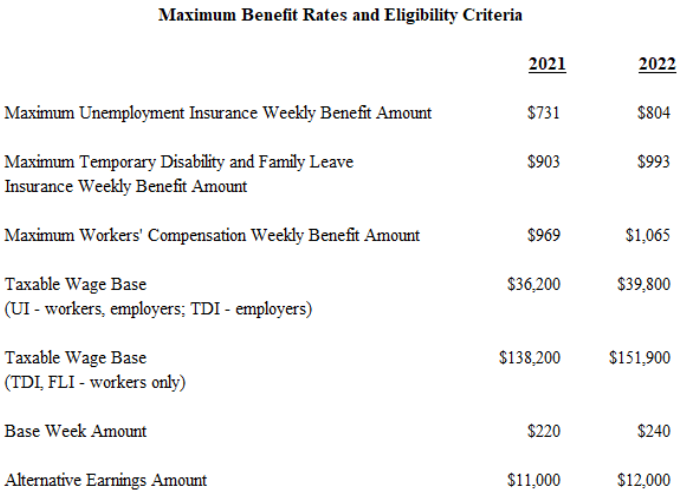

Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio.

2020 New Jersey Payroll Tax Rates Abacus Payroll

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

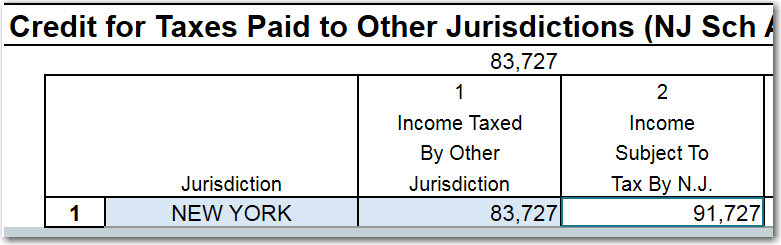

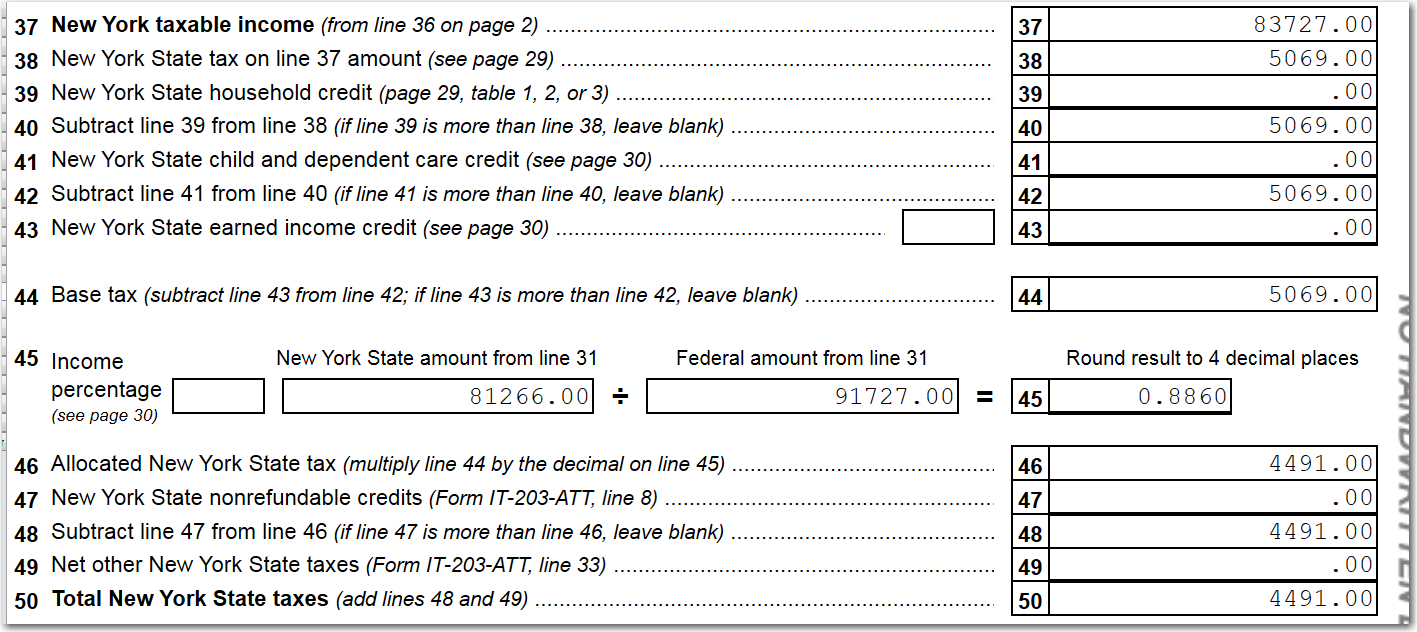

Solved I Live In Nj But Work In Ny How Do I Enter State

Solved I Live In Nj But Work In Ny How Do I Enter State

Nj Full Year Resident Ny Wages General Chat Atx Community

Nj Labor Department Max Benefit Rates Increased On Jan 1 Wrnj Radio

2019 New Jersey Payroll Tax Rates Abacus Payroll

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Solved New Jersey Non Resident Tax Calculating Incorrectl

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

.jpg)